Salesforce's $37.8B Gamble: The Crux They're Not Naming

One billion agents promised. Hundreds of engineers needed to fix the data that blocks them.

Marc Benioff promised a billion agents by end of 2025. Then two billion. Then the promise shifted to “agentic enterprise” language that sounds visionary but means:

We’re building something,

and we’re not sure the market will pay for it the way we thought.

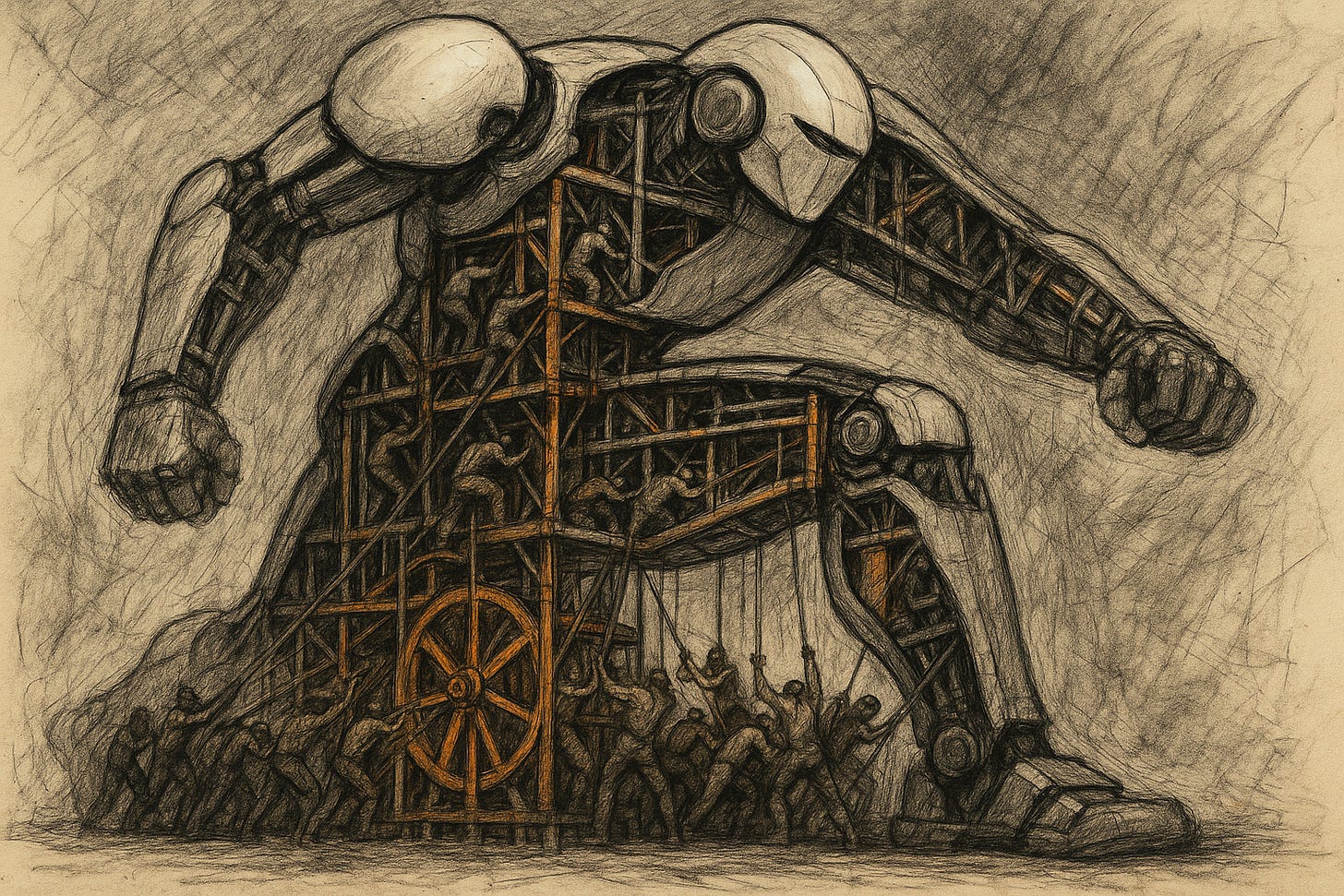

Salesforce is attempting the most audacious business model transformation in enterprise software history. Moving a $37.8B annual revenue machine from seat-based licensing to consumption-based pricing. From heavyweight CRM to AI-native agentic platform. From “seats deployed” to “agents utilized.”

The problem isn’t whether they can build Agentforce. By all means, they have.

But. The job description for “AI Forward Deployed Engineer (Senior/Lead/Principal)” signals something far more revealing.

Salesforce knows the technical platform works. What they’re struggling with is something systemic, something that can not be solved at the product level.

I. The Paradox That Breaks Everything

Here’s what’s happening in Q3 2025.

Salesforce closed “200+ Agentforce deals.” Sounds impressive until you read between the lines: Benioff called the pipeline “thousands of future quarters.” Translation: They’re stuck in pilots. Customers are evaluating, not deploying.

Meanwhile, Data Cloud (the unification layer that makes Agentforce work) is generating $900M ARR. That’s extraordinary growth. Except it represents 2.4% of total revenue. For a platform transition to be real, the new revenue model needs to be at least 15-20% of total revenue to prove the model is working.

So, why the gap?

Agentforce works technically. The gap exists because Salesforce is asking customers to solve a prerequisite problem before they can even activate the new platform.

That problem is data readiness.

II. The Market Signal Says “No more CRMs”

Here’s what the market is actually signaling. And it’s more subtle than the headlines actually suggest.

Klarna shut down Salesforce. Along with 1,200 other SaaS tools.

They recognized a fundamental problem:

Enterprise data is fractured across dozens of SaaS platforms. Each one has its own data model, its own “truth,” its own silos. When you feed fragmented data into an LLM, you get what data scientists call “shit in, shit out.”

So Klarna built an internal knowledge graph using Neo4j to unify all that scattered knowledge: theirCRM data, docs, analytics, HR records, everything. The side effect was consolidating SaaS. But the main driver was unification, not replacement.

Siemiatkowski’s conclusion:

“Salesforce will likely become that hub of knowledge that modern companies seek.”

But only if they maintain their opinion about how enterprise knowledge should be structured. The risk: Large SaaS become “glorified databases” trying to please every customer, losing the clarity that made them valuable.

This is the real market signal:

Not “kill CRM.”

But: The future belongs to platforms that unify fragmented enterprise data and maintain architectural opinion about how that data should flow.

Salesforce has the opportunity to be that platform. For that the Agentforce must be built on unified data as the foundation, rather than bolted onto existing siloed infrastructure.

The question is:

Can Salesforce do this without compromising the architectural clarity that made it dominant?

III. The Challenge Inventory

To answer that, let’s look at what actually blocks execution.

Looking at the FDE job description, other jobs postings and market position, I see four challenges:

Challenge 1: The Revenue Cannibalization Paradox:

Agentforce succeeds by reducing the need for human seats. If the platform works as intended, it actively destroys the core $37.8B seat-based revenue model before consumption revenue can replace it. This is not a theoretical problem. It’s the inverse equation: success cannibalization.

Importance: 4 out of 4. Existential. Revenue model cannibalization directly threatens the entire financial foundation. Without solving this paradox, CFO approval for full transformation collapses.

Addressability: 2 out of 4. Possible to address. Only through business model innovation that no enterprise software company at $37.8B scale has successfully executed. Pricing $2/conversation while seats are $100-300/month creates forecasting chaos. Solutions are unproven.

Stakeholder Action Impact: 4 out of 4. If this paradox is resolved by proving that consumption grows faster than seats decline), then board, investors, sales leadership, and so on, will gain confidence to commit capital and people.

Strategic Leverage Score: 32 out of 64.

Challenge 2: 25 Years of Technical Debt

Retrofitting an autonomous agentic reasoning layer onto a multi-tenant architecture designed for CRUD operations (Create, Read, Update, Delete) in 2000. The platform was built for high transaction throughput and data isolation, not for real-time reasoning, hallucination detection, or context propagation across agent swarms.

Importance: 4 out of 4. Again existential. If agentic layer can’t run on legacy infrastructure, Agentforce stays a feature, not a platform. Without solving this, the entire business model transition fails.

Addressability: 2 out of 4. Technically addressable. But requires multi-year platform re-architecture (estimated 3-5 years). Current approach: manual workarounds via FDE embedded engineers rather than systematic platform modernization.

Stakeholder Action Impact: 3 out of 4. If solved, engineering and product leadership can commit to agentic roadmap with confidence. Customers can adopt at scale. BUT: It doesn’t directly unblock the sale.

Strategic Leverage Score: 24 out of 64.

Challenge 3: The Salesforce’s Sales Force Capability Gap

A sales organization trained to sell “10 users × $150/month = $1,500 MRR” deeply struggles to sell “consumption credits at variable rates based on agent actions.” Salesforce hires 1,400 new Account Executives (AE) in Q4 2025, but hiring new people doesn’t solve the fundamental skill gap: moving from transactional (seat) to consultative (outcome).

Importance: 3 out of 4. Major. Sales cannot move deals from pilot to production without understanding “consumption ROI” mechanics. This blocks revenue realization. But it’s secondary to the data readiness problem - can’t sell consumption ROI if customer has no unified data to measure against.

Addressability: 3 out of 4. Addressable via training, hiring and incentive restructuring. Clear playbook exists (Microsoft, AWS did this with cloud adoption). Requires extended time for capability shift.

Stakeholder Action Impact: 3 out of 4. If solved, sales leadership gains confidence to commit to new comp model. AEs can move deals forward. Customers can get support they need.

Strategic Leverage Score: 27 out of 64.

Challenge 4: Customer Data Readiness Gap

78% of enterprises cannot operationalize AI beyond pilot phase because they lack the unified data foundation required to run agents safely. Agentforce depends entirely on Data Cloud providing a unified customer 360° view. Without unified data, agents cannot reason contextually. They become expensive chatbots.

Importance: 4 out of 4. Existential. Agentforce literally cannot function without unified data. No unified data = no agents. It’s the prerequisite gate for everything downstream.

Addressability: 3 out of 4. Addressable via FDE deployment and systematic data integration playbooks. Clear methodology exists (data unification is not a new problem). Current timeline: 6-12 weeks per customer. Addressability is not 4, because customers lack internal data discipline. FDEs can help but can’t solve for organizational readiness.

Stakeholder Action Impact: 4 out of 4. If data readiness compresses from 6+ months to 4 weeks: Production pilots accelerate → Consumption revenue grows → Revenue model transition becomes provable → Board confidence → Sales moves deals → CFO budget allocation shifts. This single solution removes the blocking factor for the entire system.

Strategic Leverage Score: 48 out of 64.

The Crux is Confirmed

Customer Data Readiness (48) is the root blocker. Other challenges are downstream effects.

To prove the consumption model works → Salesforce needs agents running in production at scale

To run agents in production → Customers need unified data (Data Cloud)

Most customers have fragmented data → Takes 6-12 weeks to unify

Thus they cannot activate Agentforce → Deals stay in “pilot purgatory”

Therefore Salesforce cannot prove ROI → Revenue model transformation remains unvalidated

And finally, CFO cannot authorize revenue model pivot → Cannibalization risk stays not managed

We cannot solve the revenue fear until we solve the data blocker. The “AI Forward Deployed Engineer” role confirms this hierarchy. If Agentforce were plug-and-play, Salesforce would not need to hire hundreds senior engineers to “embed deeply with client teams” and “own the entire data lifecycle.” They’re hiring humans to manually compress the data readiness timeline because the platform cannot yet do it automatically.

This analysis is part of the proprietary deep-dive library. The full strategic architecture (including the Guiding Policy and Action Roadmap) is available to paid subscribers.